Momentum, Milestones, and Market Shifts: Bitcoin's Explosive 2023–2024

How Politics, Regulation, and Market Dynamics Shaped Bitcoin’s Historic Rise

The Resilient Cycle Theory: November 2023 to November 2024

Looking back a year at Bitcoin’s journey from November 2023 through November 2024 has exemplified the enduring nature of its cycle theory, reinforcing the model despite mainstream scepticism. This cycle theory, rooted in Bitcoin’s predictable four-year halving pattern, suggests recurring phases of accumulation, rapid growth, peak euphoria, and subsequent correction.

November 2023: The Momentum Begins In late 2023, Bitcoin experienced an explosive surge driven by renewed optimism around market conditions, heightened anticipation for a potential ETF approval, and Bitcoin’s halving event scheduled for early 2024. Broader macroeconomic shifts, including increased global liquidity, underpinned this rally. As Bitcoin approached $38,000, bullish sentiment swept the market, preparing the stage for significant gains.

First Half of 2024: Pre-Halving Anticipation The early months of 2024 were marked by steady price increases fueled by excitement for the Bitcoin halving. Historically, halving events—where the reward for mining new Bitcoin blocks is cut in half—trigger a supply shock that leads to price appreciation. This period saw robust on-chain metrics such as increased long-term holder accumulation and a surge in active addresses, supporting the idea of a brewing bull market. The market sentiment became increasingly positive as Bitcoin’s price moved past $50,000, breaching critical psychological and technical levels.

Post-Halving Impact The halving event in the spring of 2024 acted as a catalyst, aligning with the cycle theory’s prediction of a significant upward movement post-halving. This was reminiscent of previous cycles where supply constraints spurred new demand, driving prices higher. Following the halving, Bitcoin quickly climbed past $70,000, spurred by institutional interest, ETF-related inflows, and expanding global liquidity.

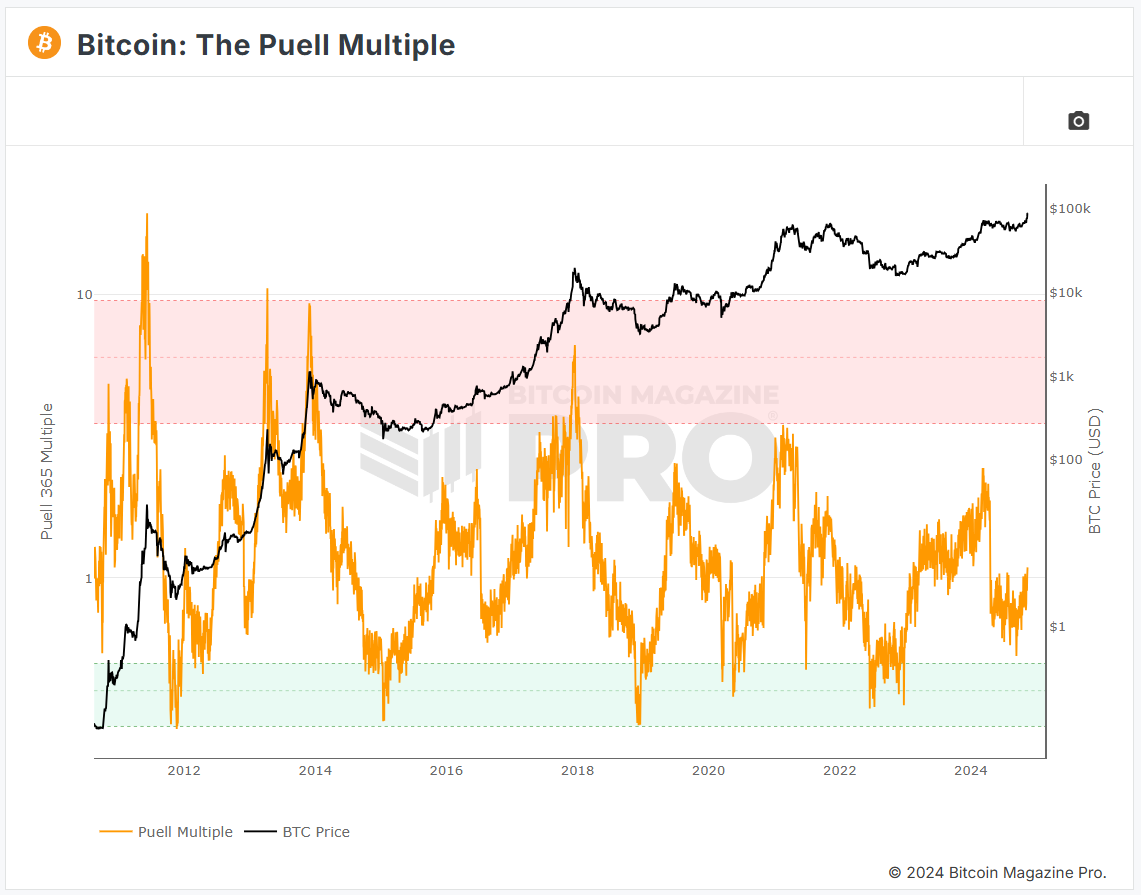

The Climb to $90,000 As 2024 nears an end, Bitcoin approaches the $90,000 mark. This growth was fueled by the anticipation of regulatory easing and the natural momentum throughout the year. Historical metrics like the Puell Multiple and MVRV Z-Score indicate a healthy market. At the same time, the Pi Cycle Top Indicator suggests that the market has room to grow before reaching speculative highs.

The Trump Era: A Renewed Optimism for Bitcoin and Crypto

The 2024 election has reshaped the landscape for Bitcoin and the broader cryptocurrency market. The crypto industry invested over $100 million into races across the U.S., aiming to bolster pro-crypto candidates and ensure a favourable legislative environment. Their efforts paid off spectacularly as Donald Trump defeated Kamala Harris, signalling the return of a pro-business, crypto-friendly administration. Trump’s win and the shift in Congress have created unprecedented enthusiasm and optimism among investors and industry stakeholders.

Bitcoin surged to nearly $75,000 on election night and reached almost $90,000 a few days ago, breaking records and propelling related crypto stocks, such as MicroStrategy (MSTR) and Coinbase (COIN), to significant gains. Trading volumes across crypto-linked assets peaked at an all-time high of $38 billion. Trump’s victory has fueled expectations of reduced regulatory pressure, with many anticipating a period of clear, growth-focused policy that will drive the sector forward.

Trump’s Impact and Policy Shift

Donald Trump’s transformation from a crypto sceptic to an advocate has been evident throughout 2024. His campaign included promises that resonated strongly with crypto enthusiasts, such as the proposal for a federal Bitcoin reserve and the expansion of Bitcoin mining in the U.S. This policy direction aligns with Trump’s broader vision of maintaining American technological and economic leadership. The alignment with Elon Musk, a significant crypto supporter, added momentum and bolstered market confidence.

Legislative and Regulatory Impact

The potential for a new SEC leadership is a pivotal focus. Gary Gensler, who has been criticized for his restrictive approach to crypto, will be replaced once Trump takes office, paving the way for more lenient policies. Under new leadership, the SEC could approve additional crypto investment vehicles, such as ETFs for smaller tokens like Solana, and further expansion of Ethereum trading vehicles, fostering market expansion and mainstream adoption. This expected regulatory shift is crucial when investor enthusiasm and institutional interest are peaking.

The Senate victories amplified this optimism. Key wins include Bernie Moreno’s defeat of crypto sceptic Sherrod Brown in Ohio and Tim Sheehy’s win in Montana. These victories, driven by substantial funding from crypto PACs, solidify a pro-crypto majority in the Senate. This pro-crypto Congress may advance legislation transferring regulatory oversight from the SEC to the CFTC, an agency perceived as more accommodating to innovation and growth.

Kristin Smith, CEO of the Blockchain Association, expressed this sentiment: “We’ve turned a corner and now have the right people in place to advance policy that will foster growth.” These legislative changes are expected to set the stage for a more supportive regulatory environment, reducing the uncertainty that has long hindered the market.

The Role of Prediction Markets

This election also showcased the growing relevance of crypto-based prediction markets. Platforms like Polymarket outperformed traditional polling methods, accurately forecasting Trump’s win and demonstrating the power of decentralized systems in political forecasting. With over $2 billion wagered on the presidential election, these markets highlighted the evolving nature of blockchain’s application beyond financial transactions and into data-driven insights.

A Promising Path Ahead

Trump’s administration promises to be a turning point for Bitcoin and the broader crypto ecosystem. The combination of clear regulatory direction, legislative support, and pro-business policies sets a strong foundation for future growth. Investors are optimistic that this environment will usher in an expanded new bull market, fostering innovation and placing the U.S. at the forefront of the global crypto landscape.

With Bitcoin trading at historic highs and market fundamentals strengthening, the industry anticipates a transformative period. Trump’s presidency, aligned with the rising influence of crucial market players like Elon Musk, suggests this is just the beginning of a significant growth phase. The era of uncertainty may be fading, replaced by a period marked by regulatory clarity, institutional expansion, and a more dynamic crypto market ready to capitalize on these favourable shifts.

Price Milestones and What Comes Next: BTC Targets and FOMO

Bitcoin recently reached the first significant Fibonacci target of $88,000-$91,000, sparking a period of consolidation. This level aligns with both Fibonacci bands and actual market liquidation levels, where short positions have been wiped out. As described by analysts, this phase marks the end of compulsory buying driven by short squeezes. The following primary target for Bitcoin is $102,000, derived from the macro Fibonacci retracement levels using the previous cycle’s high and the current cycle’s low.

Navigating Price Discovery

Breaking into all-time highs puts Bitcoin into price discovery mode, characterized by wild swings as there are no historical resistance levels. Analysts use Fibonacci bands—patterns based on natural mathematical sequences—and actual liquidation data to navigate new resistances and market behaviour.

Strategy for This Part of the Cycle

Navigating this part of the Bitcoin cycle requires strategic allocation, discipline, and adaptability. Here’s a comprehensive trading guide to help you optimize your approach:

Exit Strategy and reshuffling of assets

If you already have an exit plan, stick to it. I previously advised setting a strategy; now is the time to follow through. You are probably well into profit if you stayed with the strategy I presented through the years. If you need to earn some profit now, do it. However, consider limiting liquidations to no more than 25% of your crypto holdings at current price levels. This should be enough to take out all your original investment money and more. Selling further can be postponed until early 2025, as this rally is just beginning.

Hold onto altcoins if you believe in their potential; the start of alt season is imminent. It might be wise to pivot to more promising investments from assets that have stagnated over the last year. Ethereum, which has underperformed so far, is worth considering as a destination for stagnant altcoin conversions due to its potential under regulatory clarity and ongoing technological evolution, including the Beam Chain upgrade.

This proposed Ethereum enhancement bundles significant changes to address technical debt and integrate breakthroughs such as SNARKs, quantum resistance, faster block times, and streamlined finality, positioning it well for sustained growth.

Dollar-cost averaging (DCA)

Continue with a DCA strategy, but avoid significant, greed-driven lump-sum investments at this stage. The prime time for significant entries has likely passed. Instead, maintain steady, smaller allocations every week, and consider reducing your weekly or monthly contributions compared to earlier periods.

Monitoring market indicators for potential cycle peaks and planning exit levels is essential. Emotional traders often miss these signals, but disciplined investors who adhere to their pre-set strategies can maximize returns and minimize risks.

Alt Season Strategy

If you wish to put small amounts to altcoins, remain flexible and focused. Prioritize reliable projects and avoid consistently underperforming assets that could drain your portfolio’s potential.

Market Metrics for Confidence

The Puell Multiple: Demonstrates strong miner profitability, signalling the end of the accumulation phase and a potential bullish continuation.

Bitcoin Hashrate: Reached new highs in 2024, indicating robust network strength and substantial investments in infrastructure, boosting long-term security.

MVRV Z-Score: Evaluates market value versus realized value. Current levels suggest room for further growth without immediate overbought conditions (close to 6).

Pi Cycle Top Indicator: Used to identify market tops. As of now, it remains below critical levels, indicating the current market has room to advance before reaching a speculative peak.

By maintaining discipline and strategically navigating these metrics, and at the same time sticking without emotion to your plan, you can maximize gains and reduce risks during this cycle. Remember, the aim is to take profit and reinvest part of it into other investments if you wish and part of it back in this market when the conditions are favourable (when everyone in mainstream thinks that bitcoin is dead)

Future Targets and Investor Guidance

With the $88,000-$91,000 Fibonacci level reached, the focus shifts to $102,000 as the next primary target. Analysts also observe liquidation clusters, which could influence where the following consolidation or rally occurs. This is crucial as market behaviour in price discovery can be highly volatile, requiring strategic positioning.

Stay Alert: Follow developments through CT, Telegram, X and other platforms to remain informed and prepared.

Conclusion: Preparing for 2025 and Beyond

As 2024 closes, the theory remains steadfast: Bitcoin’s cycle-driven patterns of accumulation, halving-triggered supply shocks, and post-halving surges continue to play out with remarkable accuracy. With supportive political winds and evolving regulatory clarity, Bitcoin’s resilience amidst scepticism validates the cycle theory and hints at an exciting phase ahead. The approach to 2025 promises to break through the coveted $100,000 mark, driven by a strong base of long-term holders, increased adoption, and further regulatory progress.

Investors now find themselves at a strategic juncture—holding to maximize gains while preparing for potential profit-taking, ensuring they are well-positioned for the cycle’s subsequent phases.

Stay informed, stay strategic, and watch Bitcoin’s next big moves. The road to $100,000 and beyond may be within reach, but only those who balance emotion with discipline will navigate this journey successfully.