Hi all, I hope all of you are well.

This is a post returning from a week’s vacation to the island of Kefalonia in the Ionian Sea between Greece and Italy. It is a beautiful place so if you plan any vacations in Greece it is definitely worth a look as an option.

The world of Bitcoin is in a dynamic phase, with traditional financial powerhouses making their presence known in the crypto space. This push has contributed to Bitcoin's price crossing the significant $30,000 mark, a testimony to the cryptocurrency's growing acceptance among institutional players.

Prominent among these entrants are Fidelity National Financial, Charles Schwab Corporation, and Citadel Securities, with their joint venture - the EDX exchange platform - launched on June 20. This initiative embodies a pivotal step towards integrating traditional finance with decentralized tokens, blurring the boundaries that have long separated these two worlds.

Further underscoring the increasing institutional interest is BlackRock's recent application for a spot Bitcoin ETF in the form of a trust for retail investors. BlackRock's ambitious plan aims to democratize Bitcoin ownership, effectively bringing it to the masses.

However, the path to a Bitcoin ETF isn't devoid of hurdles. The Securities and Exchange Commission (SEC) has a history of rejecting Bitcoin ETF applications, citing the potential for fraud on crypto trading platforms as a key concern, but in reality, waging a biased war on crypto. (It is important to say though that US regulators do not view BTC and perhaps Ethereum as the rest of the crypto space. SEC has clarified numerous times that BTC is not a security but a commodity.)

Yet, the recent surge of applications to launch a spot Bitcoin ETF suggests a possible shift in the winds. Firms such as BlackRock, Invesco, and WisdomTree, among others, are displaying a growing confidence in this realm.

Adding another dimension to this evolving landscape is the Federal Reserve's recent focus on the sizable segment of the overall crypto market – stablecoins. During a semiannual hearing on monetary policy, Federal Reserve Chair Jerome Powell highlighted the need for the U.S. central bank to play a "robust federal role" in overseeing stablecoins. He also acknowledged the "staying power" of cryptocurrencies like Bitcoin, validating their relevance and potential in the evolving financial sector.

In Europe, The formidable banking entity, Deutsche Bank AG, has taken a major stride in the crypto sphere by applying for regulatory consent to operate as a crypto custodian in Germany. This development, announced last Tuesday, comes hot on the heels of BlackRock, the mammoth asset management corporation, filing the previously mentioned application with the SEC to establish a spot bitcoin ETF.

A Deutsche Bank spokesperson confirmed "We have indeed applied for the BaFin license for crypto custody," referring to the German financial watchdog. This echoes the bank's statement from February 2021, when it unveiled its interest in exploring cryptocurrency custody. The objective? To deliver an "institutional-grade hot/cold storage solution with insurance-grade protection."

Deutsche Bank's proposed digital asset custody platform will roll out in phases. When fully operational, it will empower users to trade digital assets through prime brokers and offer a suite of services. These will range from taxation and valuation services to fund administration, lending, staking, and voting, among others.

The bank is no stranger to crypto ventures. In a recent endeavor, its asset management group, DWS, allegedly initiated negotiations to secure a minority stake in two crypto enterprises – Deutsche Digital Assets, an exchange-traded products provider, and the trading firm Tradias.

In a conference, David Lynn, the head of Deutsche Bank's commercial banking unit, announced that the bank is currently "building out [its] digital asset and custody business," according to a Bloomberg report.

Back in February, DWS CEO Stefan Hoops expressed his belief that the prevalent low crypto prices could open up "interesting opportunities" for the asset management division. The latest move by Deutsche Bank certainly emphasizes the growing intersection of traditional finance and the world of crypto.

Looking at the broader picture, the merger of traditional finance and the crypto world is poised to boost Bitcoin's market cap and influence, solidifying its dominant position. If a Bitcoin ETF garners approval, it will open the floodgates to a broader spectrum of investors, thereby potentially driving Bitcoin prices upward. Countries that have previously banned crypto assets may reconsider their stance in light of these developments, further widening the market for Bitcoin.

Bitcoin's allure seems to be growing stronger by the day. Coupled with the ongoing accumulation of Bitcoin into off-exchange wallets, this momentum signals a bullish outlook for the crypto giant. As the boundaries between traditional finance and the crypto world continue to blur, we can expect to witness exponential growth in Bitcoin's market cap and influence. The increasing involvement of the Federal Reserve and its views on stablecoins is a further testament to this growing integration of traditional finance and crypto markets. As this trend continues to gain momentum, we can look forward to a transformative era in the world of finance.

Onto the technicals

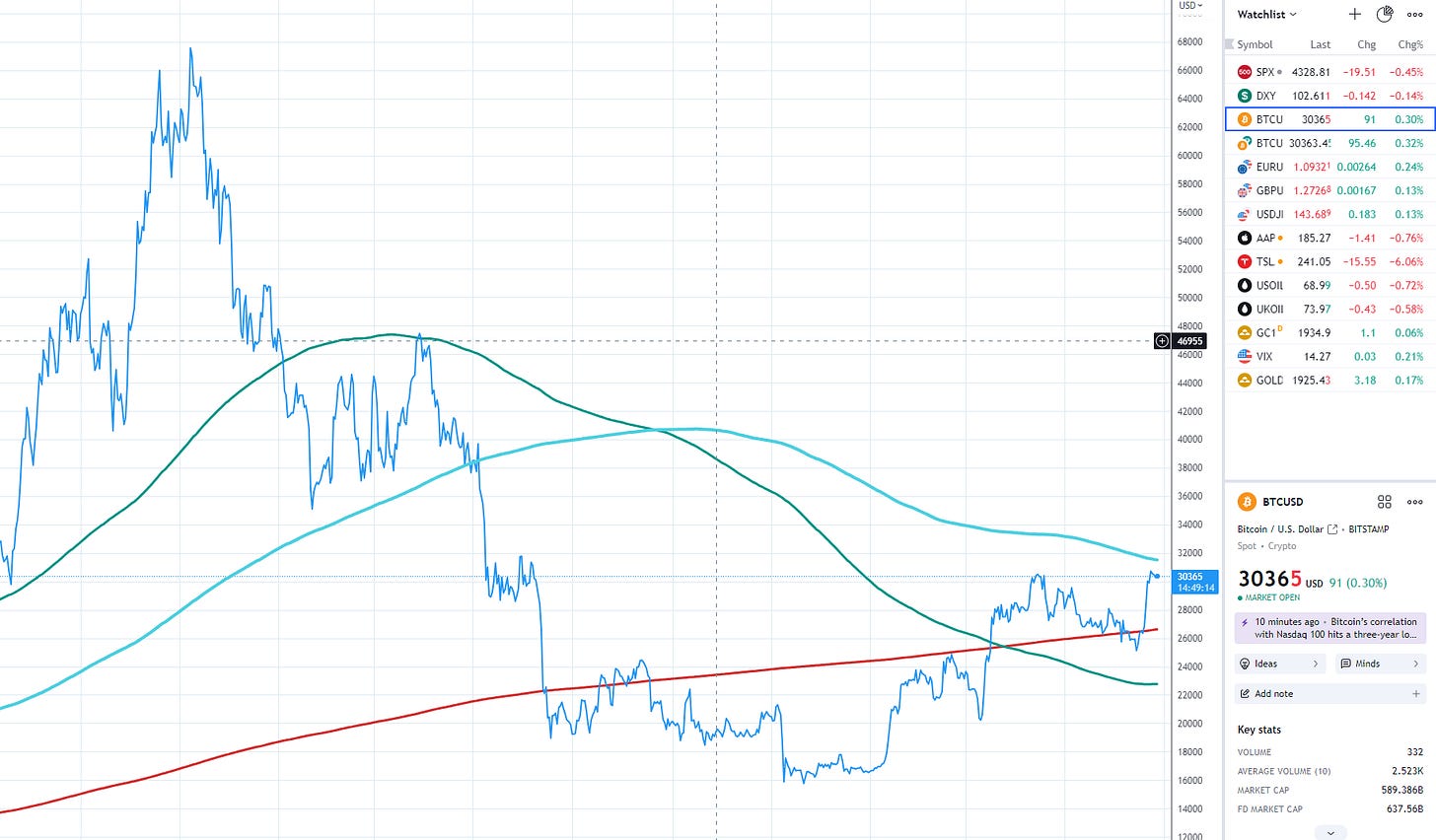

We have mentioned in the past that once BTC conquers the critical level of 30k, this will serve as a confirmation that the worse of the bear market is behind us. At this stage, I personally don’t expect BTC to slide towards a new cycle low. We have transitioned to the Accumulation stage of the cycle (See more info on the BTC cycle in this post:

The 200WMA (red line) has held as a support zone for a while now.

This possibly signals the end of fire sales for this cycle, and I sincerely hope that some of you have managed to capitalize on this. However, we're still in a prime buying zone, so a measured accumulation strategy is the way to go. I can't stress enough the importance of conviction and knowledge in this dynamic landscape. Continuous self-education is key and remember, avoid allocating more capital than you can mentally withstand in the face of this space's inevitable hyper-volatility.

As much as I wish to fuel your optimism, it's crucial to acknowledge the looming uncertainties. The macro-environment, to be honest, remains worrisome. The banking sector's health metrics are far from encouraging, hinting that we may witness more banks falter. The ongoing war shows no signs of ending, and frankly, we seem to be strolling quite leisurely towards the unspoken reality of a recession. It's important to tread this terrain with an informed mind and a resilient spirit. All these can individually escalate to market-crashing realities. Let’s hope for the best, and keep on top of your investments.

Happy Summer holidays!